幸运飞行艇开奖记录查询结果|飞艇168官方开奖历史记录+结果官网直播计划 Bring your story to life

ProWritingAid helps you craft, polish, and elevate your writing.

幸运飞行艇168官方开奖历史记录 全年所有历史记录 Why choose ProWritingAid?

ProWritingAid is the essential toolkit for storytellers helping over 3 million writers craft their stories and bring them to life

In-depth analysis & actionable feedback

Tailored analytical tools assess every aspect of your writing in seconds and teach you how to improve.

Works with your favorite writing app

ProWritingAid works wherever you do, fitting neatly into any writing app like Word, Google Docs, or Scrivener.

Your writing is safe with ProWritingAid

Your writing is sacred, so we use bank-level security to keep it safe and never use your text to train our algorithms.

“ProWritingAid makes my writing better.”

Learn how ProWritingAid has helped bestselling author Leeanna Morgan edit her 59 published novels.

飞艇168官方开奖历史记录+结果官网直播计划、幸运168飞艇官方网站 Your masterpiece is just a few clicks away

Unlock your potential with our easy-to-use writing assistant.

Actionable advice to improve your writing

Make your writing more powerful in seconds. Enhance your sentences instantly by adding sensory details, eliminating weak words, and fixing common mistakes.

Comprehensive story critiques in seconds

Learn your story’s strengths, weaknesses, and areas for improvement with the touch of a button. Get custom suggestions for how to enhance your plot, characters, setting, and more.

Suggestions to help keep your readers hooked

Make your story come to life with “show, don’t tell” suggestions. Our sensory reports and pacing improvements will help you identify places to further engage your readers.

Tools for finding inspiration

Beat writer's block for good with tools to help you start or continue writing. With ProWritingAid, the right words are always at your fingertips.

“ When I started out... it was just me and ProWritingAid against the world basically. ”

Works in all your favorite writing apps

Access all ProWritingAid's features directly in your writing app of choice.

Built by writers, for writers

Our story began with a problem

In 2012 in London, our founder wanted to write a novel but was struggling with self-doubt. ProWritingAid was his solution to that problem and led to him discovering his passion. Ten years later, ProWritingAid has helped over 2 million people become better storytellers.

We keep your writing safe

As writers ourselves, we know how important the privacy and security of your writing is. That's why we never use your text to train our algorithms and use bank-level security to keep your work safe.

全年幸运飞行艇168官方开奖历史记录 历史结果 开奖记录查询结果 Written with ProWritingAid

Join the bestselling authors who used ProWritingAid to edit their books.

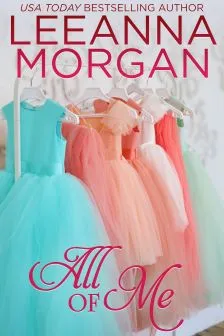

All of Me

USA Today bestselling author Leeanna Morgan’s poignant romance about a young widow finding a second chance at love in a small mountain town.

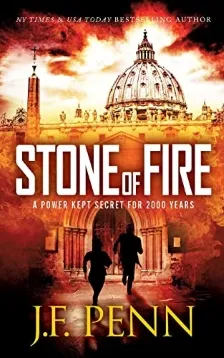

Stone of Fire

J.F. Penn, New York Times bestselling author, delivers a thrilling archaeological adventure filled with danger, conspiracy, and ancient secrets.

Sanctuary

A spellbinding tale of magic, romance, and adventure set in a secret school for supernatural beings, from USA Today bestselling author Melle Amade.